Funds which invest a large portion of their corpus in companies with

large market capitalization are called large cap funds. This type of

fund is known to offer stability and sustainable returns, over a period

of time. Because large cap companies are so large and have a well

established reputation with consumers, they are less likely to come

across a business or economic circumstance that forces them to stop

revenue producing operations completely.

There are many large cap funds that are great income vehicles for those who want to take on less risk. Franklin India Opportunities Fund is one such fund which invests in large cap companies and has consistently given good returns. The fund is ranked 1 by CRISIL in large cap fund category.

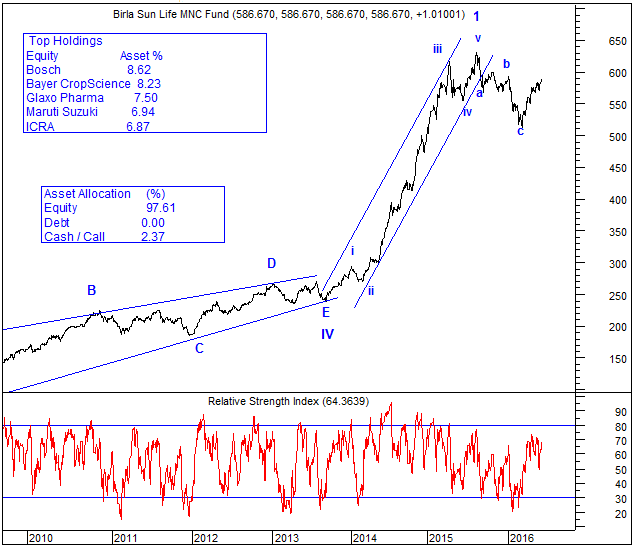

Franklin India Opportunities Fund – Weekly Chart

Franklin India Opportunities Fund (G) is an open ended diversified equity fund that invest in diverse mix of securities that cut across sectors along with it focuses on capitalizing long term growth opportunities by investing in Indian Economies. This fund has 95% exposure to Equity.

Portfolio analysis: The fund has selected sectors or stock exposure based on four prominent themes as follows:

Investment rationale: We would suggest someone comfortable investing in complete equity with diversified holdings of large cap stocks and at the same time can take some risk to get better returns can opt for this fund. Fresh investment must be done once the previous pivot resistance of 60 levels is taken out decisively.

In a nutshell, this fund looks to be the best performing among large cap funds. The break of 60 levels will provide excellent opportunities to investors to enter in staggered fashion and ride closer to their goals!

Start your Blue chip Investments with us and get Online Portfolio Access plus Monthly Account Statements plus Crystal Clear Advisory from Industry Experts plus Exclusive Elliott Wave based Research Reports and many more User-friendly Services.

Click HERE for more details.

There are many large cap funds that are great income vehicles for those who want to take on less risk. Franklin India Opportunities Fund is one such fund which invests in large cap companies and has consistently given good returns. The fund is ranked 1 by CRISIL in large cap fund category.

Franklin India Opportunities Fund – Weekly Chart

Franklin India Opportunities Fund (G) is an open ended diversified equity fund that invest in diverse mix of securities that cut across sectors along with it focuses on capitalizing long term growth opportunities by investing in Indian Economies. This fund has 95% exposure to Equity.

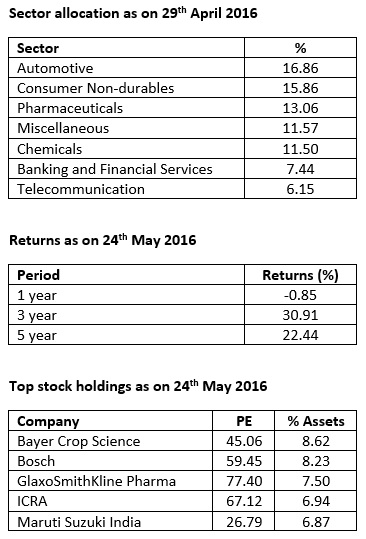

Portfolio analysis: The fund has selected sectors or stock exposure based on four prominent themes as follows:

- Companies operating in areas where India has a strong advantage

- Global competitive Indian companies with potential to participate in global opportunities

- Undervalued companies

- Companies best positioned to take advantage of opportunities arising from a growing economy

Investment rationale: We would suggest someone comfortable investing in complete equity with diversified holdings of large cap stocks and at the same time can take some risk to get better returns can opt for this fund. Fresh investment must be done once the previous pivot resistance of 60 levels is taken out decisively.

In a nutshell, this fund looks to be the best performing among large cap funds. The break of 60 levels will provide excellent opportunities to investors to enter in staggered fashion and ride closer to their goals!

Start your Blue chip Investments with us and get Online Portfolio Access plus Monthly Account Statements plus Crystal Clear Advisory from Industry Experts plus Exclusive Elliott Wave based Research Reports and many more User-friendly Services.

Click HERE for more details.